Aladingsc Insights

Your go-to source for trending news and informative guides.

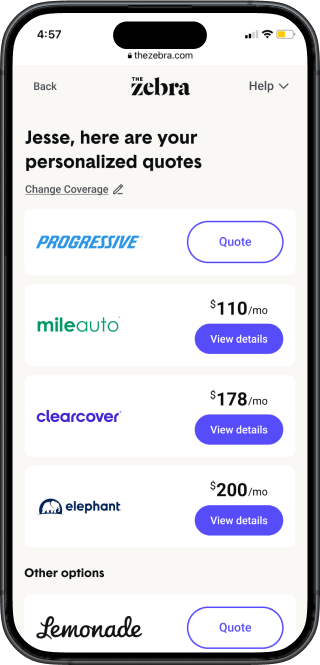

Quote Quest: Navigating the Maze of Insurance Options

Unlock the secrets to insurance! Join us on Quote Quest and master the maze of options for the best coverage tailored to you.

Understanding Different Types of Insurance: A Comprehensive Guide

Insurance is a crucial tool that offers financial protection against unforeseen events and risks. Understanding the different types of insurance available can help individuals and businesses make informed decisions that best suit their needs. Some of the most common types of insurance include life insurance, which provides financial support to beneficiaries upon the policyholder's death; homeowners insurance, which protects your home and belongings against damages or theft; and health insurance, which covers medical expenses. Familiarizing yourself with these options allows you to evaluate risks and tailor your insurance portfolio accordingly.

In addition to the common types mentioned, there are specialized insurance products that cater to specific needs. For instance, auto insurance protects drivers against financial loss in case of accidents, while business insurance safeguards companies from liabilities and property losses. Understanding different types of insurance can also involve considering options like disability insurance, which provides income to individuals unable to work due to injury or illness, and travel insurance, which covers unexpected travel-related incidents. Overall, recognizing the diversity in insurance products enables you to secure better coverage and peace of mind in various aspects of your life.

Top 5 Questions to Ask When Choosing an Insurance Policy

Choosing the right insurance policy can feel overwhelming, but it's crucial for ensuring your financial security. Here are the top 5 questions to ask:

- What coverage is included? Understanding what is and isn't covered by the policy will help you avoid any unpleasant surprises later. You may want to compare different types of coverage available, such as homeowners insurance and health insurance.

- What is my premium and deductible? Clarifying the amount you will need to pay monthly (premium) and how much you must pay out-of-pocket before your insurance kicks in (deductible) is essential. This will influence your budget, so be sure to ask for a detailed breakdown.

Additionally, consider these important questions:

- How do claims work? Knowing the process of filing a claim and the typical time it takes can save you stress during crucial moments. Getting a clear understanding of the insurer's claims process can also help you gauge their efficiency and responsiveness.

- Are there any discounts available? Many insurance providers offer discounts for various reasons, such as bundling policies or having a good driving record. Asking about available discounts can significantly lower your costs.

- How reputable is the insurance company? Researching customer reviews and ratings can give you insight into the company's reliability and customer service. Websites like J.D. Power provide industry insights and customer satisfaction ratings.

Navigating Deductibles and Premiums: What You Need to Know

When it comes to understanding health insurance, deductibles and premiums are two key concepts that everyone should grasp. The premium is the amount you pay for your insurance policy, typically on a monthly basis. This cost can vary widely based on several factors, including the type of plan, your age, and the coverage level. In contrast, a deductible is the amount you must spend out of pocket before your insurance begins to cover expenses. For example, if your plan has a $1,000 deductible, you will need to pay that amount each year before your insurer will start paying for covered services. If you want to learn more about how health insurance works, consider visiting HealthCare.gov for comprehensive resources.

Understanding the relationship between deductibles and premiums is critical to making informed decisions about your health insurance. Generally, plans with lower premiums tend to have higher deductibles, meaning you pay less each month but may face greater out-of-pocket costs before receiving benefits. Conversely, choosing a plan with higher premiums often results in lower deductibles, which can be beneficial if you anticipate frequent medical care. To get a comprehensive breakdown of various plan types and their implications, refer to the insights available on NerdWallet.