Aladingsc Insights

Your go-to source for trending news and informative guides.

Protecting Your Stuff: Why Renters Insurance is a No-Brainer

Discover why renters insurance is essential for safeguarding your belongings. Don't risk it—learn how to protect what matters most!

Top 5 Reasons Why Renters Insurance is Essential for Every Tenant

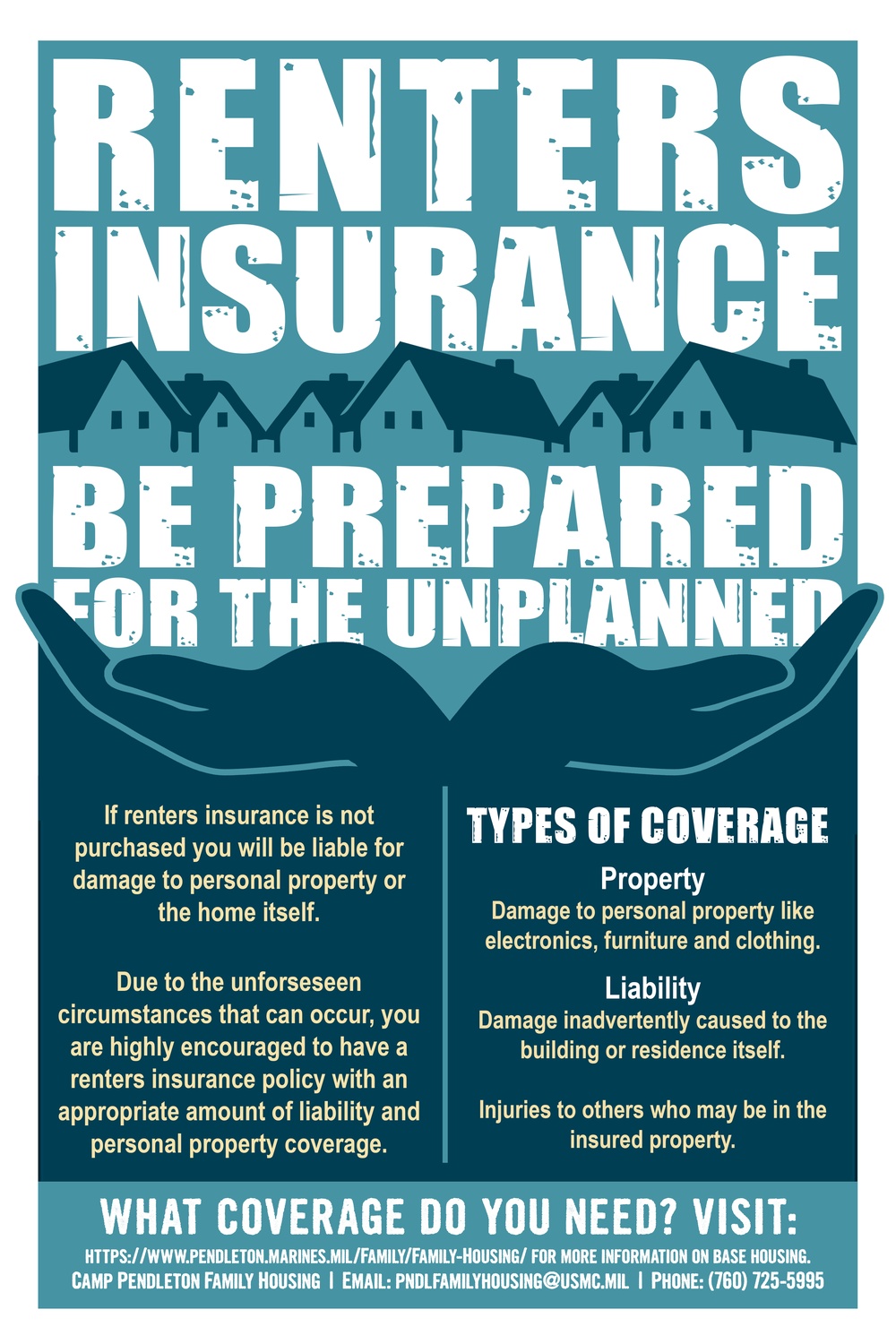

Renters insurance is often overlooked by tenants, yet it plays a crucial role in protecting individuals from unforeseen circumstances. One of the top reasons to consider renters insurance is that it provides coverage for personal property. Whether it's theft, fire, or natural disasters, having renters insurance ensures that you have financial support to replace your belongings. According to the Geico, renters insurance can cover a wide variety of valuable items, giving you peace of mind in case the unexpected happens.

Another significant reason why renters insurance is essential is liability coverage. If a guest gets injured in your apartment or you accidentally damage someone else's property, renters insurance can help protect your financial interests. This type of coverage can cover legal fees, medical bills, and more. As noted by the Bankrate, having this protection can save you from facing substantial out-of-pocket costs that could arise from everyday accidents.

What Does Renters Insurance Actually Cover? A Comprehensive Guide

Renters insurance is designed to provide financial protection for tenants against unexpected events that can lead to loss or damage of personal property. Typically, renters insurance covers personal belongings such as furniture, electronics, clothing, and appliances. The coverage usually applies to losses resulting from theft, fire, vandalism, and certain types of water damage. Additionally, most policies include liability coverage, which protects you if someone is injured in your rental unit or if you accidentally cause damage to someone else's property.

It's important to note that while renters insurance provides broad coverage, there are exceptions. For instance, certain high-value items like jewelry, art, and collectibles may require additional floater policies for full protection. Moreover, renters insurance typically does not cover damages caused by natural disasters like floods and earthquakes, unless you purchase specific add-ons or separate policies to address these risks. Understanding what is and isn’t covered in your policy can help you make informed decisions when choosing renters insurance.

Is Renters Insurance Worth It? Debunking Common Myths and Misconceptions

When considering whether renters insurance is worth it, it's essential to debunk some common myths. A prevalent misconception is that your landlord’s insurance covers your personal belongings. However, landlord insurance typically protects only the property itself, leaving renters vulnerable to loss or damage. According to the National Association of Insurance Commissioners, this means that in the event of theft, fire, or other disasters, you could be left without any financial recourse for your belongings. Therefore, securing your personal assets with renters insurance is a smart choice.

Another myth is that the cost of renters insurance is prohibitive, leading many to believe that it simply isn’t worth the investment. In reality, renters insurance is often more affordable than you think. According to ValuePenguin, the average premium can be as low as $15 to $30 per month, depending on location and coverage options. This minimal cost can provide substantial peace of mind in protecting your valuables, with policies often covering liabilities as well as loss of personal property.