Aladingsc Insights

Your go-to source for trending news and informative guides.

Crypto Chaos: Riding the Waves of Market Volatility

Navigate the wild world of crypto! Discover tips and tricks to thrive amid market chaos and profit from volatility like a pro.

Understanding Market Volatility: Key Factors Driving Cryptocurrency Prices

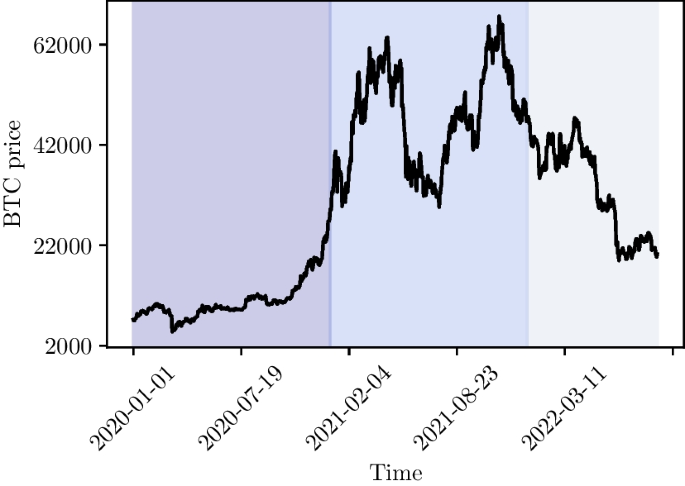

Understanding market volatility is crucial for anyone involved in the cryptocurrency space. Several key factors drive the fluctuations in cryptocurrency prices, including regulatory news, technological advancements, and market sentiment. For instance, announcements regarding government regulations can lead to significant price swings, either bullish or bearish, depending on the nature of the news. Similarly, innovations like upgrades to existing blockchain technologies or the introduction of new cryptocurrencies can impact investor perceptions and contribute to price volatility.

Another important factor to consider is market sentiment, which often drives short-term trading patterns. Speculative trading can amplify price movements, as investors react emotionally to market trends and news. Platforms like social media and forums play a significant role in shaping this sentiment, creating a feedback loop that can result in rapid price fluctuations. By keeping an eye on these key drivers of volatility, investors can make more informed decisions and navigate the unpredictable waters of cryptocurrency trading.

Counter-Strike is a highly popular team-based first-person shooter that has captivated millions of players worldwide. It emphasizes strategic gameplay and teamwork, allowing players to engage in intense matches. For an added thrill, check out this cloudbet promo code to enhance your gaming experience.

Top Strategies for Navigating Crypto Market Turbulence

In the ever-evolving world of cryptocurrencies, navigating market turbulence is crucial for investors looking to safeguard their assets and maximize opportunities. One of the top strategies involves conducting thorough research and staying updated on market trends. Utilizing tools like price alerts and analytics platforms can provide real-time insights into market movements. Additionally, joining online forums and communities can facilitate knowledge sharing and help you gauge market sentiment. This proactive approach not only aids in making informed decisions but also helps in identifying potential volatility in the market.

Another effective strategy for managing crypto market turbulence is diversification. By spreading your investments across various cryptocurrencies, you can mitigate risks and avoid heavy losses associated with a single asset's decline. Consider adopting a mix of established cryptocurrencies like Bitcoin and Ethereum, along with promising altcoins. Furthermore, employing risk management techniques, such as stop-loss orders, can protect your investments during sudden market shifts. By adopting these strategies, investors can better position themselves to weather the storm of crypto market turbulence and potentially benefit from the upswings that often follow.

Is Now the Right Time to Invest? Analyzing Current Trends in Crypto Chaos

As we navigate through the unpredictable landscape of cryptocurrency, many investors are asking, Is now the right time to invest? Current trends highlight a mix of chaos and opportunity, making it crucial to analyze the market dynamics before committing your funds. Recent fluctuations have showcased notable volatility, with coins like Bitcoin and Ethereum experiencing significant price swings. For those considering entering the market, evaluating the factors driving these changes is essential. Here are a few trends to consider:

- Increased regulatory scrutiny and its impact on investor confidence.

- The rise of decentralized finance (DeFi) and its potential to reshape traditional investment strategies.

- Institutional adoption and its role in mainstream acceptance of cryptos.

Moreover, the current economic climate plays a pivotal role in determining if this is indeed the right time to invest. With inflation rates rising and traditional asset classes showing signs of fatigue, more investors are turning to crypto as a hedge. However, it is important to remember that investing in cryptocurrencies carries inherent risks due to their speculative nature. As such, individuals should conduct thorough research and consider factors such as their investment horizon and risk tolerance. Only then can you make an informed decision about whether to dive into the world of cryptocurrencies in this tumultuous yet exciting period.