Aladingsc Insights

Your go-to source for trending news and informative guides.

Dance of the Digital Dollars: Navigating Crypto Market Swings

Master the art of crypto trading! Uncover strategies to thrive amid market swings and elevate your investment game. Join the dance today!

Understanding Market Volatility: How Crypto Prices Fluctuate

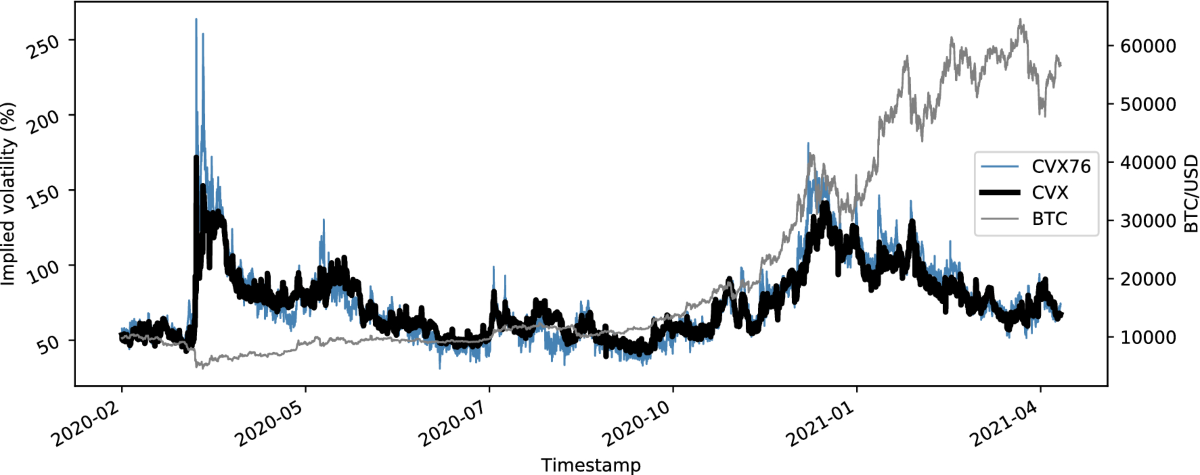

Understanding market volatility is crucial for anyone involved in the cryptocurrency space. Prices of cryptocurrencies are known for their significant fluctuations, often influenced by various factors ranging from market sentiment to regulatory news. For instance, events such as government regulations, technological advancements, and macroeconomic trends can trigger rapid price changes. These fluctuations can create both opportunities and risks for investors, making it essential to stay informed about the factors affecting the market.

One of the key aspects of crypto price volatility is the role of speculation. The crypto market is heavily influenced by traders' expectations and emotions, leading to price swings that can happen within minutes. Additionally, major events, such as the launch of a new blockchain project or a high-profile hack, can result in significant market reactions. Understanding these dynamics will help investors make more informed decisions and navigate the ever-changing landscape of cryptocurrency prices.

Counter-Strike is a popular tactical first-person shooter game that has gained a massive following worldwide. Players can engage in competitive matches, showcasing their skills in teamwork and strategy. For those looking to enhance their gaming experience, using a cloudbet promo code can offer exciting bonuses and promotions.

The Basics of Crypto Trading: Tips for New Investors

Embarking on the journey of crypto trading can be both exciting and overwhelming for new investors. To navigate this volatile landscape, it’s essential to grasp the fundamentals. Start by educating yourself on the various cryptocurrencies available, such as Bitcoin, Ethereum, and altcoins. Each has distinct characteristics and use cases. Follow trusted sources and engage in reputable forums to stay updated on market trends. Remember, knowledge is your best ally in making informed trading decisions.

Another critical tip for new investors is to develop a solid trading strategy. This involves setting clear goals, understanding your risk tolerance, and deciding on entry and exit points for trades. Consider using tools like stop-loss orders to minimize potential losses and never invest more than you can afford to lose. Additionally, keeping emotions in check and resisting the urge to make impulsive decisions can significantly improve your trading outcomes. Building a disciplined approach will pave the way for a more successful experience in the world of crypto.

What Factors Influence Cryptocurrency Value?

Several factors influence cryptocurrency value, with supply and demand being one of the most critical. Just like any other asset, when demand for a cryptocurrency exceeds its supply, its price tends to rise. Conversely, if more people are looking to sell a cryptocurrency than buy it, its value is likely to decline. Additionally, external factors such as market sentiment, global economic conditions, and government regulations can impact demand significantly. For example, positive news about blockchain technology can lead to increased interest and investment, boosting the cryptocurrency's value.

Another crucial element affecting cryptocurrency valuation is technology and innovation. Each cryptocurrency operates on its own underlying technology, and significant advancements or upgrades can enhance its usability and security, attracting more investors. Moreover, the involvement of large institutions or endorsements from influential figures can create a ripple effect, resulting in heightened market activity. Finally, the overall market trends, such as the performance of mainstream cryptocurrencies like Bitcoin and Ethereum, can also dictate how investors perceive and value smaller altcoins.