Aladingsc Insights

Your go-to source for trending news and informative guides.

Riding the Rollercoaster: How Crypto Market Volatility Shapes Your Investment Journey

Navigate the wild ride of crypto market volatility! Discover how market ups and downs shape your investment strategy and maximize your gains.

Understanding Market Fluctuations: What Drives Crypto Volatility?

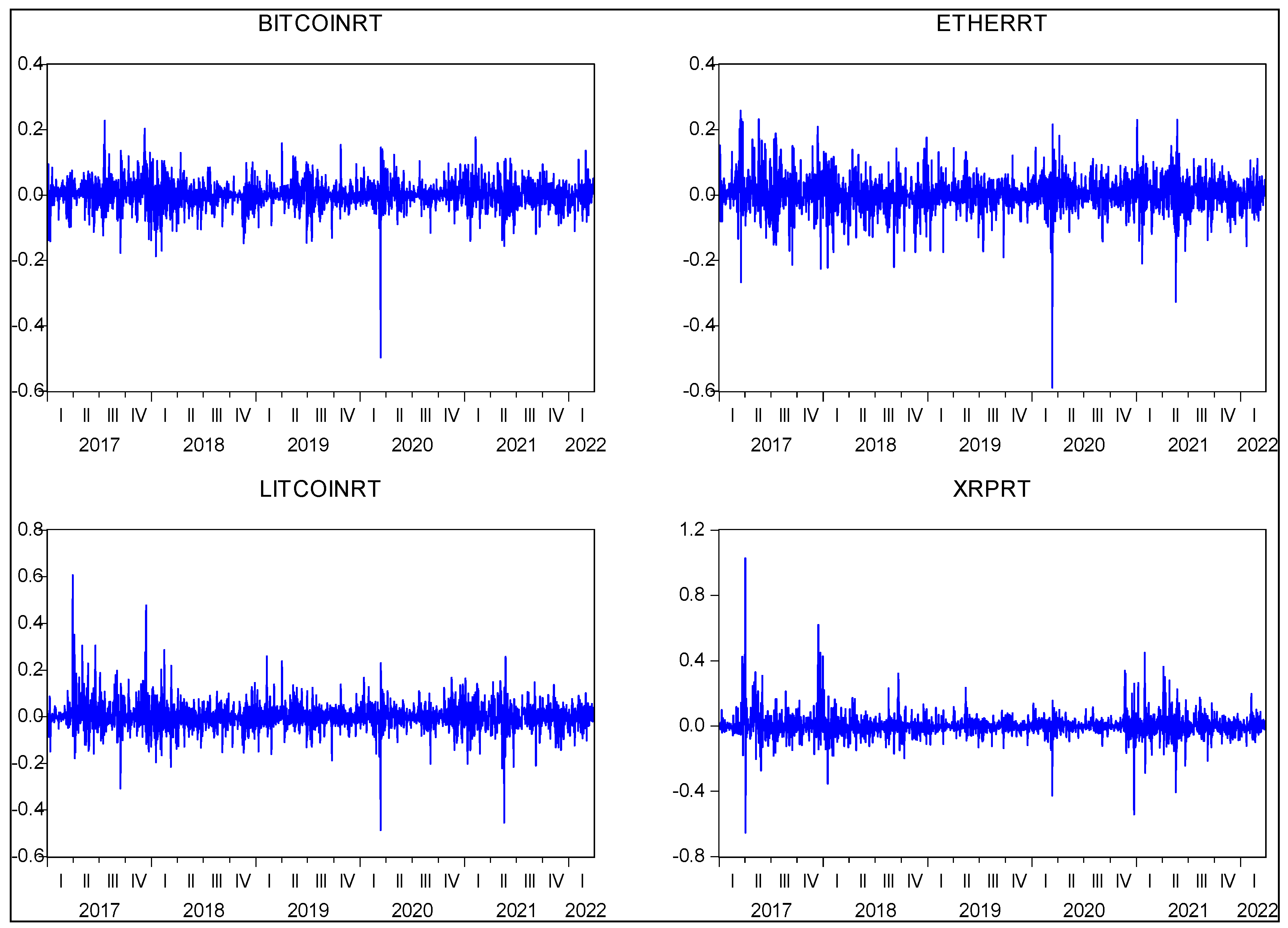

To truly grasp market fluctuations, it’s essential to understand the factors that drive crypto volatility. Unlike traditional assets, cryptocurrencies are significantly influenced by a mix of social, economic, and technological elements. Key factors include market sentiment, regulatory news, and technological advancements. For instance, a surge in demand due to positive sentiment can trigger rapid price increases, while regulatory scrutiny can lead to sharp declines. Additionally, innovations within the blockchain space, such as new functionalities or upgrades, can also create unpredictable market movements.

Another influential aspect of crypto volatility is the role of market participants. Retail investors, institutional money, and market manipulators all contribute to price swings. Remarkably, a single large purchase or sale can engender significant shifts in market dynamics. Furthermore, liquidity, or the ease with which assets can be bought or sold without affecting the price, plays a vital role. In less liquid markets, small trades can lead to substantial price volatility. Thus, understanding these variations is crucial for investors navigating the often tumultuous waters of the cryptocurrency market.

Counter-Strike is a popular tactical first-person shooter game that pits terrorists against counter-terrorists in various gameplay modes. Players can engage in intense matches while utilizing strategy and teamwork to secure objectives. For those looking to enhance their gaming experience, checking out a cloudbet promo code can offer exciting benefits.

Navigating the Ups and Downs: Strategies for Investing in a Volatile Crypto Market

Investing in a volatile crypto market can be a daunting task for many, but with the right strategies in place, traders can navigate the ups and downs more effectively. One fundamental approach is to diversify their portfolio. Instead of putting all your eggs in one basket, consider spreading your investments across various cryptocurrencies. This not only helps mitigate risks but also allows you to capitalize on the potential gains from different coins. Additionally, staying informed through reliable news sources and market analysis can equip you to make timely decisions, which is crucial in a fast-moving environment.

Another effective strategy is to adopt a long-term perspective. Short-term fluctuations can be nerve-wracking, but investing with a longer horizon may provide more stability and the potential for significant returns. Implementing tools such as stop-loss orders can also protect your investments by automatically selling assets when they hit a certain price, thereby minimizing losses during downturns. Finally, maintaining emotional discipline is vital. Resist the urge to make impulsive decisions based on fear or greed, and stick to your investment plan to successfully navigate the crypto landscape.

Is Crypto the New Rollercoaster? Assessing Risk and Reward in Your Investment Journey

The world of cryptocurrency resembles a rollercoaster, characterized by extreme highs and lows that can leave investors breathless. As more people dive into this volatile market, it's crucial to understand both the risk and the potential reward associated with these digital assets. To better assess your investment journey, consider the following factors:

- Market Volatility: Prices can swing dramatically within short periods.

- Long-term Potential: While short-term gains can be enticing, many investors focus on the long-term outlook as technology matures.

- Diversification: Just like a well-designed rollercoaster, having a diverse portfolio can help manage risk.

Investing in crypto requires a keen sense of timing and strategy. As you assess your own willingness to embrace the rollercoaster ride of crypto investing, keep in mind the importance of education and research. Start by staying informed about the latest trends and regulatory changes that can impact your investments. Additionally, consider consulting with financial experts and fellow investors to gain insights and support. By carefully weighing the risk versus reward, you can navigate this thrilling market with confidence and make informed decisions that align with your financial goals.