Aladingsc Insights

Your go-to source for trending news and informative guides.

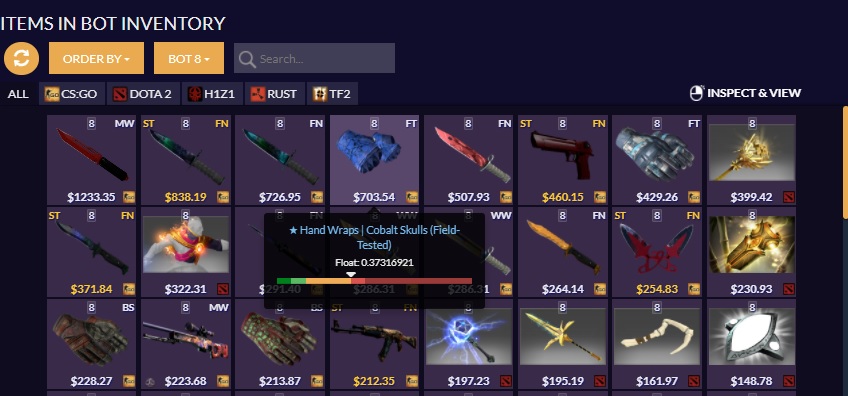

Trade Smarter, Not Harder: How CS2 Trade Bots Are Changing the Game

Discover how CS2 trade bots are revolutionizing trading strategies. Trade smarter, boost profits, and enhance your game instantly!

Exploring the Future of Trading: The Role of CS2 Trade Bots

As we venture into the future of trading, one pivotal element is the emergence of CS2 trade bots. These automated trading systems leverage advanced algorithms and machine learning to analyze market trends and execute trades with speed and precision. By removing human emotions from the trading equation, CS2 trade bots aim to enhance efficiency and profitability. Investors are increasingly adopting these tools to stay competitive, responding quicker to market fluctuations and capitalizing on opportunities that manual trading might miss.

The potential of CS2 trade bots extends beyond mere execution of trades. They can also assist in strategy development, risk management, and portfolio optimization. With features like backtesting and real-time analytics, traders can utilize these bots to refine their strategies based on historical data. As technology continues to evolve, integrating artificial intelligence and natural language processing, the role of CS2 trade bots is set to expand, ushering in a new era of automated trading that promises to be more agile and data-driven than ever before.

Counter-Strike is a highly popular tactical first-person shooter game series that emphasizes team-based gameplay and strategy. Players engage in competitive matches where they take on the roles of terrorists or counter-terrorists. For those looking to enhance their gaming experience, you can learn how to show fps cs2 to monitor your performance during matches.

How to Choose the Right CS2 Trade Bot for Your Trading Strategy

Choosing the right CS2 trade bot is a critical step in enhancing the effectiveness of your trading strategy. With a plethora of options available, it's essential to evaluate each bot based on its features, performance, and compatibility with your specific investment goals. Begin by analyzing the bot's algorithm: look for one that aligns with your trading style, whether it's day trading, swing trading, or scalping. Additionally, consider the bot's user reviews and feedback from the trading community to gain insights into its reliability and success rate.

Another important factor is the customizability of the trade bot. A good CS2 trade bot should allow you to tailor settings according to your strategy, such as risk tolerance and trade frequency. Ensure that it offers robust support and documentation to assist you in setting up and optimizing your trading parameters. Lastly, always test the bot using a demo account before committing real funds, as this will help you gauge its performance without financial risk.

Are CS2 Trade Bots the Key to Maximizing Profits in Today's Market?

In the rapidly evolving landscape of online gaming, CS2 trade bots have emerged as a potential game-changer for players looking to maximize their profits. These automated tools operate by assessing market trends, executing trades based on predefined algorithms, and capitalizing on price fluctuations. By employing a CS2 trade bot, players can save time and effort while consistently identifying lucrative opportunities in the market. This enables them to not only enhance their trading strategies but also to gain a competitive edge over those who trade manually.

However, while maximizing profits through the use of trade bots can be enticing, it's imperative to understand the intricacies involved. Not all bots are created equal; factors such as reliability, supported features, and user reviews play critical roles in their effectiveness. Furthermore, traders should remain vigilant and not rely solely on automation. A combined approach that includes manual analysis can lead to better decision-making and ultimately greater financial success in today’s market.